Medicare Supplement / “Medigap”

Medigap plans are a wonderful option for those eligible for Medicare:

It covers the bills (or, “gaps”) that Original Medicare does not;

Allows for one’s freedom to go to almost any doctor or hospital where Medicare is accepted;

Ensures predicatibility of cost;

Reduces surprise medical expenditures;

No prior authorzations required;

No pre-approvals.

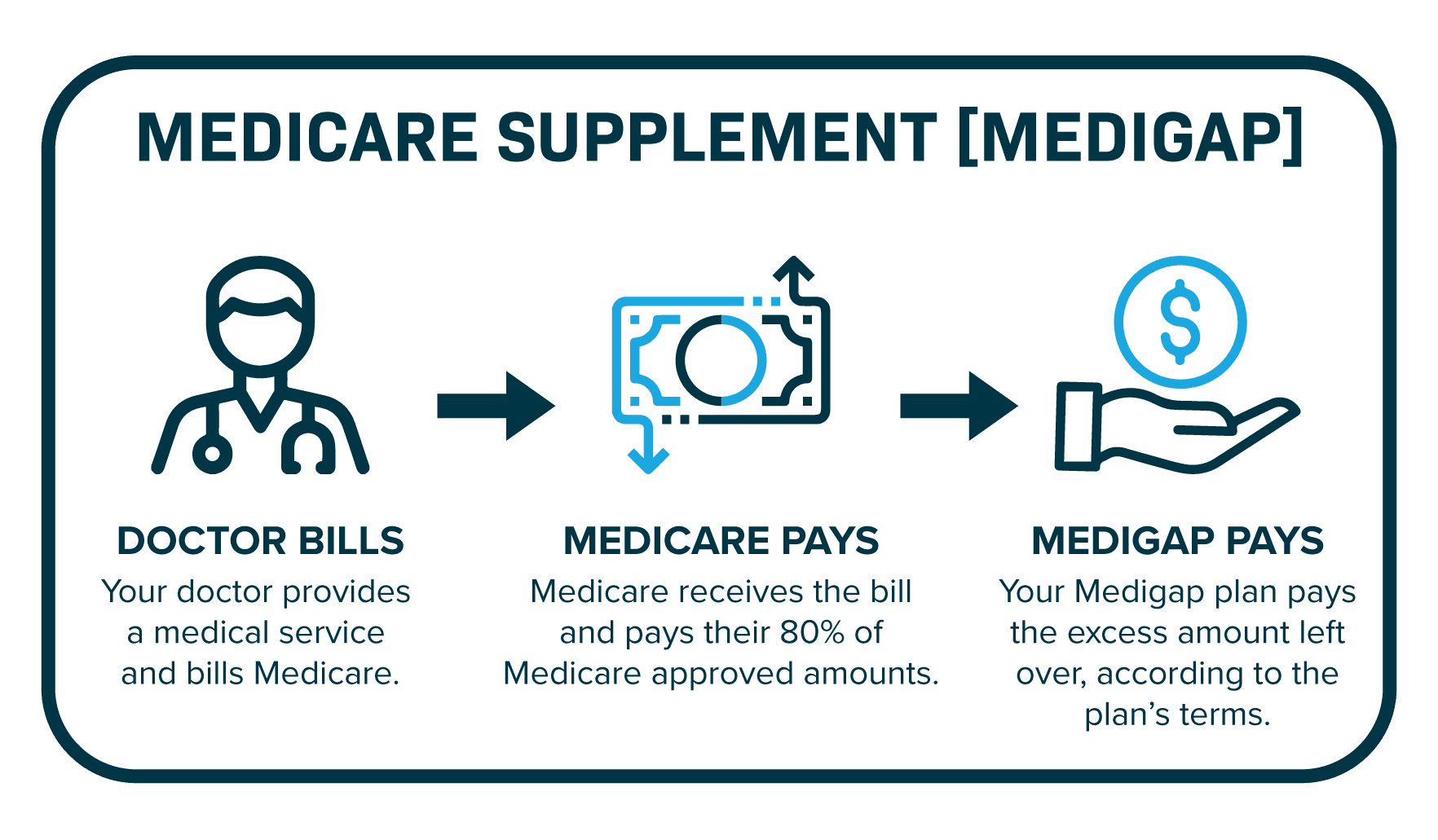

When you choose a Medicare Supplement, Original Medicare Parts A & B pay – or go into motion – first.

As noted above, depending on your Medigap choice, the plan fills in the gaps accordingly. Medigap plans are standardized across the country. Medigap plans are defined by letters which makes Medicare even more confusing. Medicare Parts A, B, C, and D. Medigap plans A, B, D, G (HDG), K, L, M, and N. C and F (HDF) is still available if you aged into Medicare before 1/1/2020.

The two most popular plans chosen are Plans G & N. However, the High Deductible G is a powerful and cost effective plan, but is often not mentioned by agents because of its low commissions.

That’s right. I said it (this is what an agent-advocate should do!). Agent commissions are low in large part because the premium costs are low.

These Medigap plans are great for those who are willing to take a little more risk in their coverage, are fairly healthy, and have a decent understanding of how insurance works.

The cost savings can be significant, while accruing all of the benefits mentioned above in flexibility and peace of mind.

Once you have a Medicare Supplement, you can't lose this coverage as long premiums are paid. Certain states have unique rules for their plans, but generally you must go through a series of health questions if you want to switch plans in the future. They do not follow the same rules as Medicare Advantage and Prescription plans. There is no Annual Election Period (10/15-12-7), but it's still a great time to review the plan along with the prescription drug plan you may have purchased when you enrolled.